Here at Thinkific, we respect creator educators — not because you make us money, but because we understand the challenges that come with running an online business, especially when you sell digital products. As your business expands, you likely have to deal with managing payments from students across different countries, handling recurring subscriptions for your exclusive content, upselling related courses, and staying on top of tax obligations so you don’t get hit with penalties.

Believe me, we get it.

That’s why we went back to the drawing board to figure out a way to help our customers navigate these administrative headaches so they can spend time doing what they love: teaching and expanding their online businesses.

Sure enough, we came up with a product feature called TCommerce. With this feature, you’re equipped with a comprehensive suite of business management and selling tools that simplify the complexities of online transactions.

TCommerce, through Thinkific Payments, streamlines the process of accepting payments from students worldwide. Whether your learners are in the United States, Europe, or Asia, TCommerce ensures that payments are processed smoothly, reducing the hassle of dealing with multiple payment gateways and currencies. But it also does way more than just handle payments, as we’ll see in a bit.

Here’s what Veronica Wasek, the founder of 5 MB Academy, has to say about TCommerce:

“I can’t tell you how much simpler bookkeeping is, now that I’m with TCommerce. We had installment payments which took a long time to manage on Stripe — it’s so easy to do it on Thinkific!”

Want to know how TCommerce can transform your business operations? Keep reading.

Skip ahead:

- Advanced Selling Tools

- Optimized Payment Solutions

- Integrated Bookkeeping Tools

- Thinkific Payments: An Integrated Payment Processor

Advanced Selling Tools

What if I told you that, in addition to making global payment processing seamless, TCommerce can also help you make more money? Cool, right? What differentiates TCommerce from other payment platforms out there is that it gives you access to a suite of powerful, integrated selling tools designed to help creators like you increase your conversions and average order value.

Boost Sales and Expand Your Reach with Gifting

The go-to way of expanding your reach as an online business owner is by running paid ads on search engines and social media platforms. If you do your targeting well and you have a sizeable enough budget, you can certainly get the results you’re looking for through paid ads. If your targeting is poor, however, your money will go down the drain.

Now, we’re not trying to scare you off paid ads — they’re an incredible way to reach a new audience and we recommend it if you have the budget for it. But if you don’t (or you want to try something different first), TCommerce can help you with that.

How, you ask? Through the Gifting feature.

The Gifting feature allows you to sell your learning products as gifts that your audience can give to their friends, family members, and loved ones. This exposes you to a new audience that’ll get to derive value from your expertise and potentially pay it forward to their own network in the future.

After analyzing the data, we discovered that Thinkific customers who use Gifting as a buying option by default at checkout generate up to 6.2% larger average transaction sizes. 6.2 percent! And you don’t have to do anything except use TCommerce.

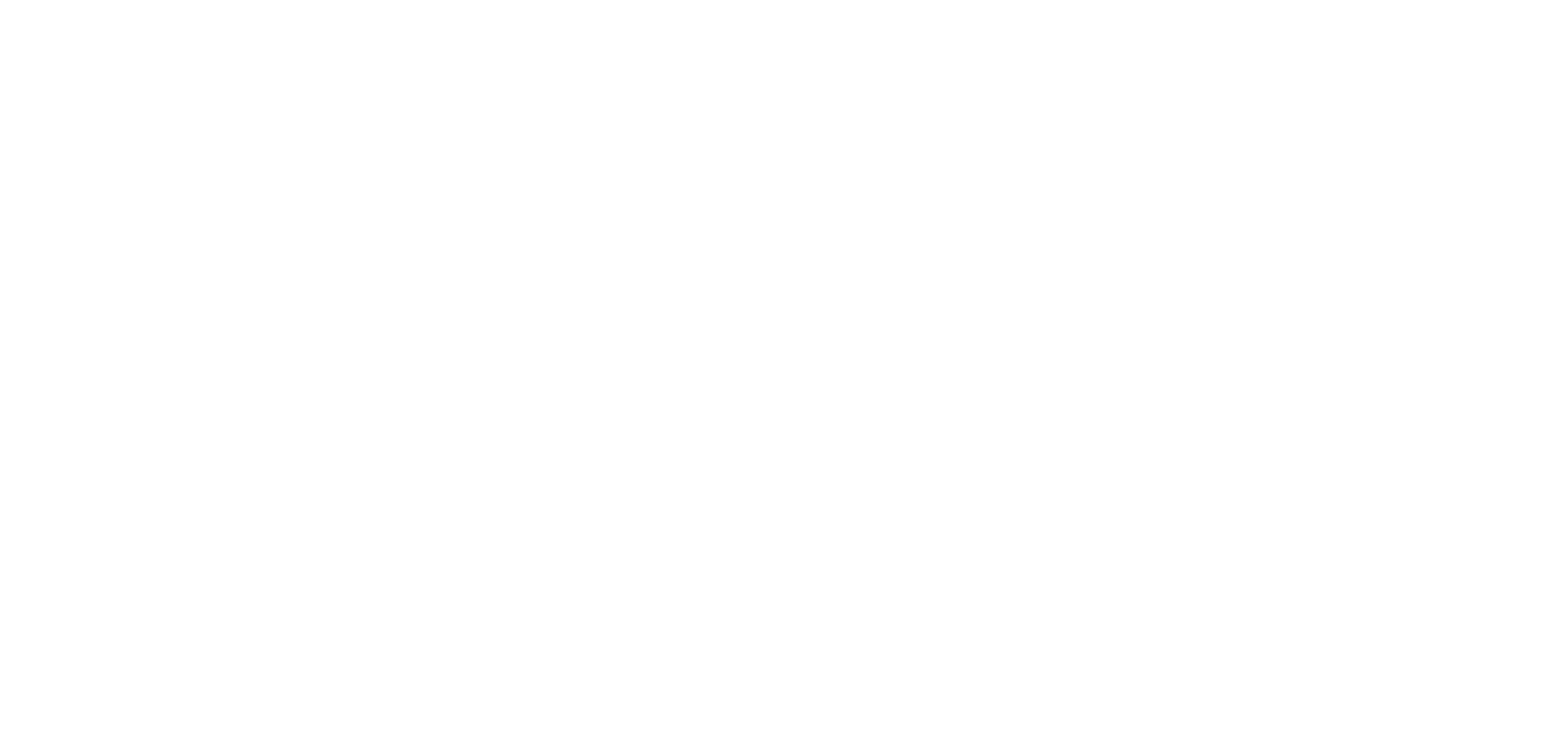

The Gifting feature is enabled by default on your website’s checkout page when you enable TCommerce by adopting Thinkific Payments as your primary payment processor. Thus, buyers can choose to purchase your product as a gift for someone during checkout. They can also add a custom message to help the recipient use the product effectively.

Once someone buys your product as a gift for another person, you’ll get a new order email notification, which specifies the recipient who received the gift invitation email. After the recipient redeems the gift, you’ll receive another order email notification confirming their redemption. Thinkific records the purchase and redemption of the gifted product as separate orders in your orders table.

There are some caveats to using this feature though. One, your customers can only buy one gift at a time. Two, you can only use the Gifting functionality on all your one-time payment products that don’t include an order bump offer.

Increase Average Order Value with Order Bumps

One of the most effective ways to increase your average order value (AOV) is to cross-sell — which means to suggest a product that complements what a customer is already buying. For example, when someone buys a smartphone, the seller will almost always suggest a phone case to go along with it.

That’s the concept behind Order Bumps.

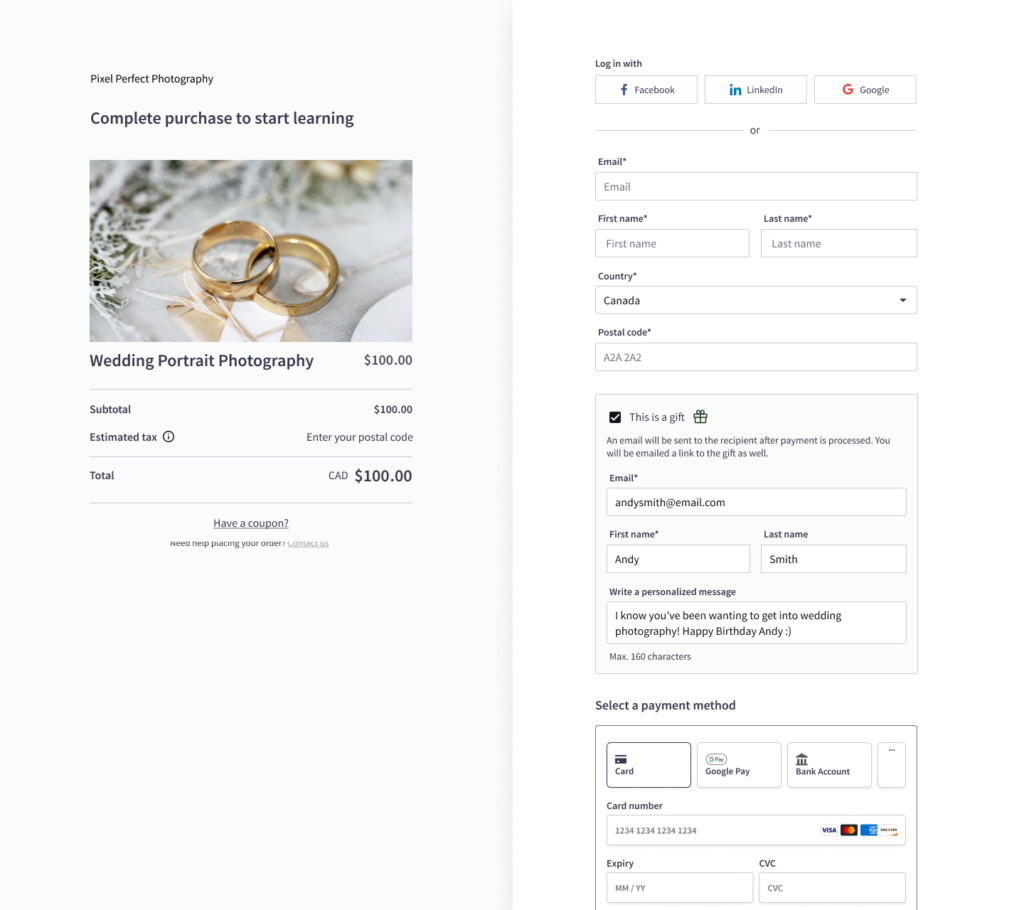

This feature allows you to offer additional products on the checkout page when your students purchase a product. Since the person is already prepared to buy one product from you, they’ll be more likely to purchase a related product provided that they can perceive the added value they’ll receive from spending more money. The order bump product can be anything: a digital resource, an online course, a tool, a one-on-one coaching session, or even a community.

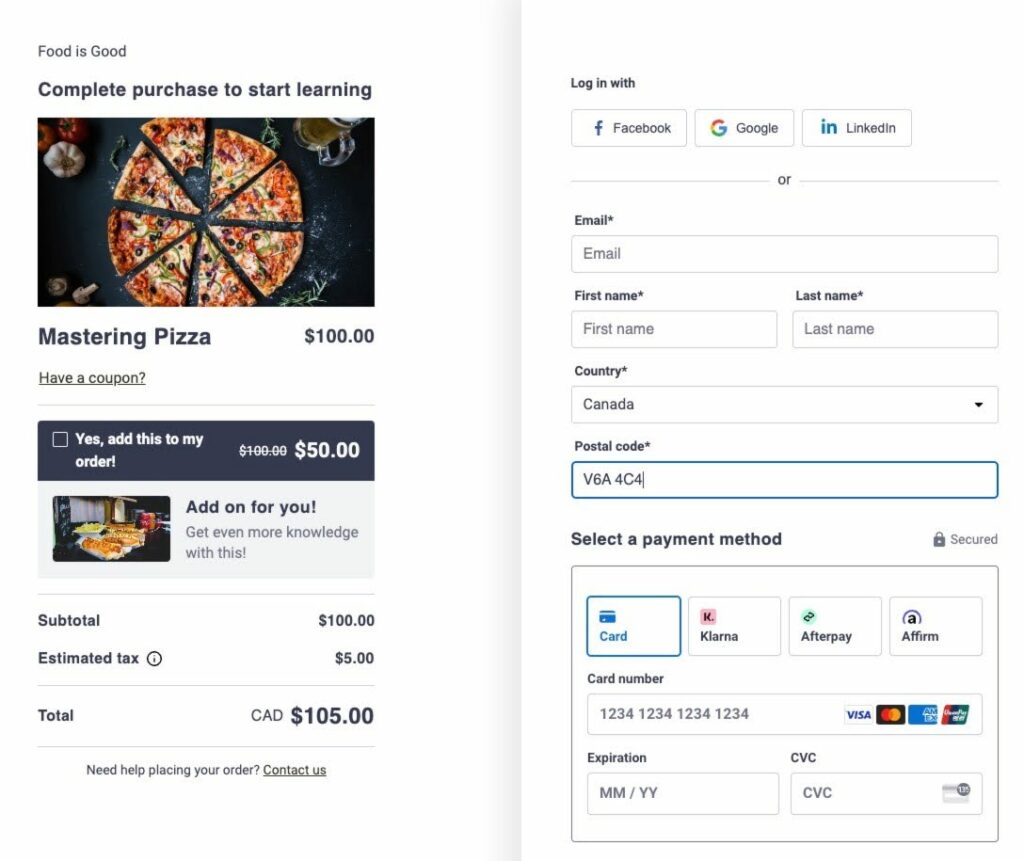

Here’s what an order bump looks like on the checkout page.

In typical TCommerce fashion, the checkout process is seamless. Your students can purchase order bumps by simply checking a box to add the product and paying for everything in a single transaction. Easy peasy. Once someone purchases an order bump, they’ll immediately gain access to both the primary product and the order bump, plus any welcome emails or other processes you’ve set up for both products.

Again, we analyzed the data and realized that creator educators who use Order Bumps see a 20% larger average transaction size. That’s more than twice the order size you get with Gifting. Don’t believe us? Ask Matthew Chapman, martial arts coach and the founder of Mittmaster.

After teaching in-person classes for many years, Matthew decided to take his business online by offering online courses teaching different types of martial arts for people of all skill levels. At first, Matthew’s business, Mittmaster, didn’t perform well. His major challenge was that it took a long time to find and convert new leads, and many of them were one-time buyers.

“The hardest part about selling and marketing was driving traffic to my Thinkific website,” Matthew recounts. “The other challenge is that many of my students only purchased one course and never looked through the other offerings.”

That is, until he implemented Order Bumps on his website. Order Bumps made it possible for Matthew to suggest complementary courses for purchase on the checkout page. For example, if someone’s buying the Mittmaster Kickboxing Instructional (Volumes 1-5), he could suggest they add on the Mittmaster Kickboxing Instructional (Volumes 6-10).

In the first month of enabling Order Bumps on his website, the average dollar spent on each order increased and Matthew’s revenue went up by an average of 20-50%.

“After setting up TCommerce, I went into my dashboard and set up my first Order Bump that same day. Within a couple of hours, I got my first Order Bump purchase. It just goes to show how easy it is!”

On the efficacy of Order Bumps, Matthew says, “50% of people who see one of my Order Bumps purchase the product. It’s been incredibly effective. Some days, 75% of people are going for the Order Bump!”

Read Matthew’s case study: TCommerce Tools: How ‘Mittmaster’ Uses Order Bumps to Boost His Revenue

Sell More Products with Group Orders

With the Gifting feature, people can only buy one gift for others. But sometimes, people may want to buy multiple “copies” of your product. That’s what the Group Orders feature is for: it offers your customers a streamlined way to buy multiple seats for the same product, increasing your revenue and business growth.

When you use this feature, everything is handled automatically at the built-in checkout, so you don’t have to use any additional integrations, implement shady workarounds, or spend time and energy negotiating and administrating. Just enable the feature in your Admin dashboard and you can sit back and focus on creating amazing content for your audience.

What’s more, your tax will automatically be calculated and added to the price you set for your products before the transaction is processed. This way, your business will no longer absorb the varying tax costs across different jurisdictions.

Group Orders are available for all kinds of products (one-time pricing only), including online courses, digital bundles, and communities, and you can accept payments through different methods, including credit card, BNPL (we’ll cover this soon), bank transfer, and more.

Recover Missed Sales Opportunities with Incomplete Purchase Reminders

Have you ever been browsing through an online store, put some products in your cart, but forgot to checkout — only to receive an abandoned cart email a couple of hours later? The email headline usually goes something like this: “{First name}, your cart is expiring soon” or “Hey, {first name}, you seem to have left your {product} behind!”

I’m sure you have. Emails like these remind customers to revisit the website and complete their purchase (or retry it).

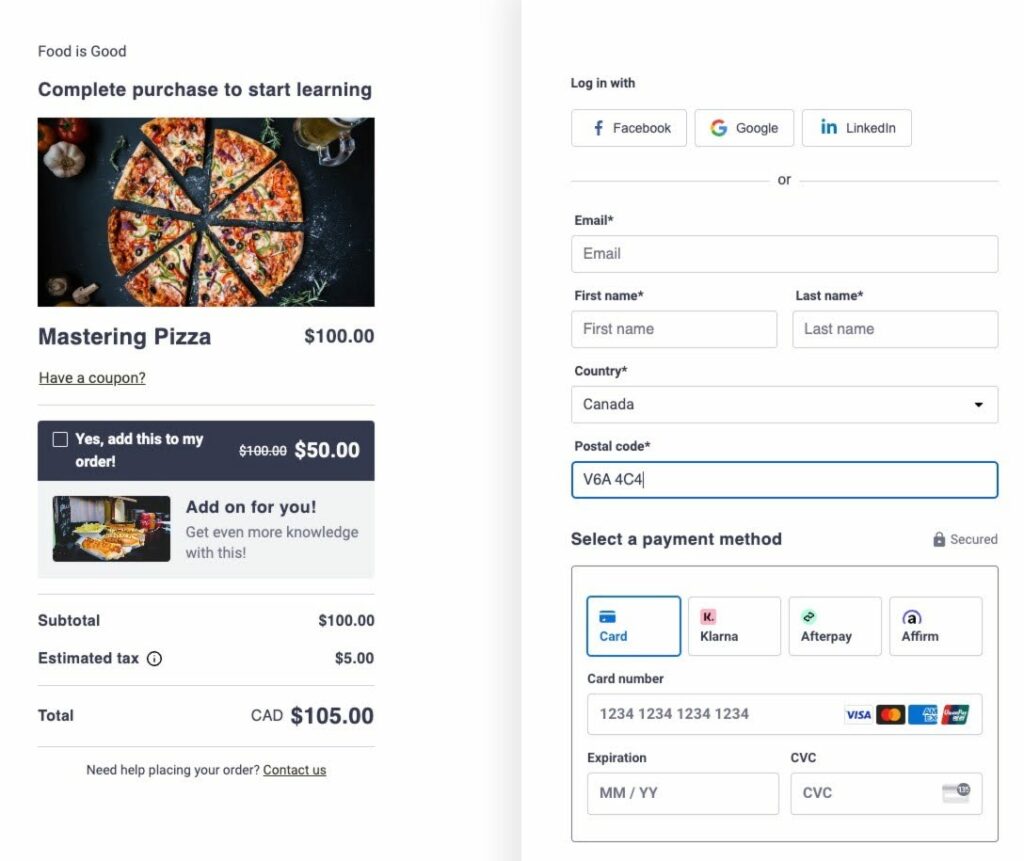

Your business loses money when prospective learners don’t go through with their transactions because they run into payment issues like expired cards or insufficient funds. Thankfully, the Incomplete Purchase Reminders feature allows you to send email notifications to these people, encouraging them to go back to the checkout page and retry their purchase.

A simple email like the one above can remind people of the value they stand to gain when they purchase your product, which can lead them to try again. This email notification is sent only if the potential customer hasn’t completed their purchase within 2 hours of the first failed attempt, so you don’t have to worry about spamming people.

Increase Checkout Conversions with Smart Retries

In recent research, Stripe discovered payment failures are to blame for 25% of invalid subscriptions. These unplanned cancellations (also called involuntary churn) are caused by elements like insufficient funds, expired card numbers, or technical payment problems. What this means is that, if you sell subscriptions to a community or bootcamp, roughly one-quarter of all failed subscriptions will be involuntary churn.

To fix this problem, Stripe created Smart Retries, which TCommerce customers can use because of our partnership with Stripe. Using machine learning, Smart Retries can find the best times to retry failed payment attempts to increase the chances of a payment going through.

When we looked at the data, we discovered that customers who enabled Smart Retries on their websites were able to earn up to 30% more revenue!

This is not surprising considering the amount of work that went into creating the feature.

Stripe used over 500 attributes to train the Smart Retries machine learning model, including:

- Customer attributes (their location, payment patterns, overall success rate of their transactions)

- Business attributes (industry, geography, currency)

- Payment attributes (the history of successful and failed transactions for a specific card)

- Seasonality attributes (time of day, day of the week, week of the month, month of the year)

- Billing attributes (business’ product mix, how customers with successful payments use the product mix)

Read: How We Built It: Smart Retries

Optimized Payment Solutions

Buy Now, Pay Later

Don’t you just love it when you happen upon an online store that allows you to pay for an item in installments? Well, that’s exactly what TCommerce’s Buy Now, Pay Later (BNPL) feature allows you to offer your students.

This flexible and interest-free payment option makes your offerings more affordable and lowers the barrier for students to purchase them. When you allow people to pay in installments, you’ll likely see more purchases from people who wouldn’t have bought from you otherwise. Not everyone can afford to pay $279 at a go for an online course, but if you allow them to pay $95 every month for three months, they just might buy the course.

We found that Thinkific transactions made with BNPL have an average order value over 3x higher than transactions made with cards — and TCommerce customers who offer BNPL at checkout earn 7.5% more revenue on average.

Isn’t that neat?

Mina Irfan of The Universe Guru loves the psychology behind the BNPL feature. “Something I didn’t expect is that, by offering Buy Now, Pay Later payment methods to my audience, my students actually feel more seen and heard. I feel my students are grateful that I’m supporting them in this way, which in turn makes it easier for them to support me.”

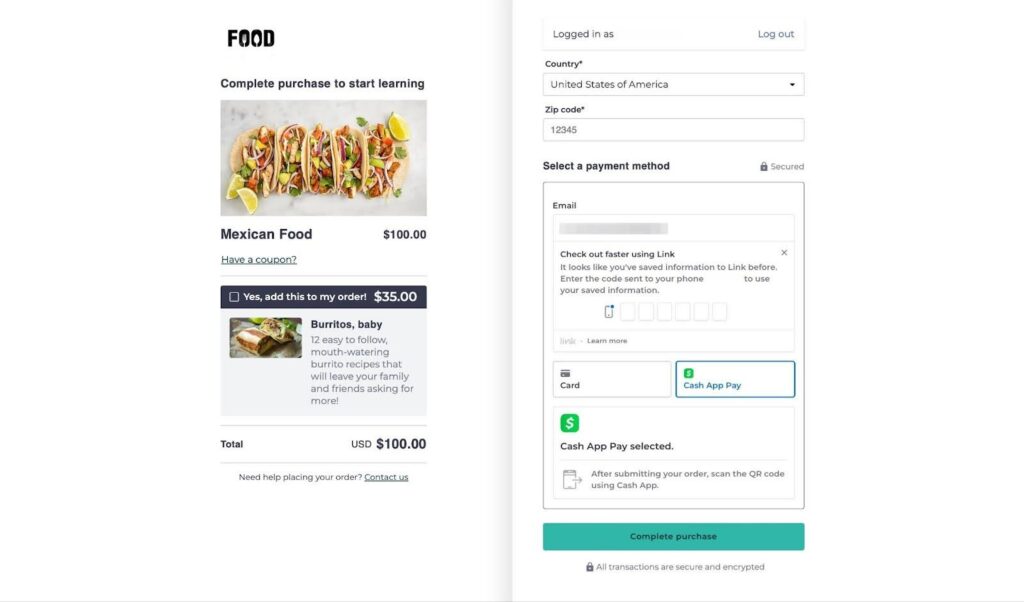

Thinkific Payments processes BNPL services from payment providers like Affirm, Afterpay, and Klarna. During the checkout process, learners will have the option of completing their purchase with the BNPL providers that are available in the country they live in. When they make a choice, they will be directed to the provider’s website to create an account and then complete the purchase.

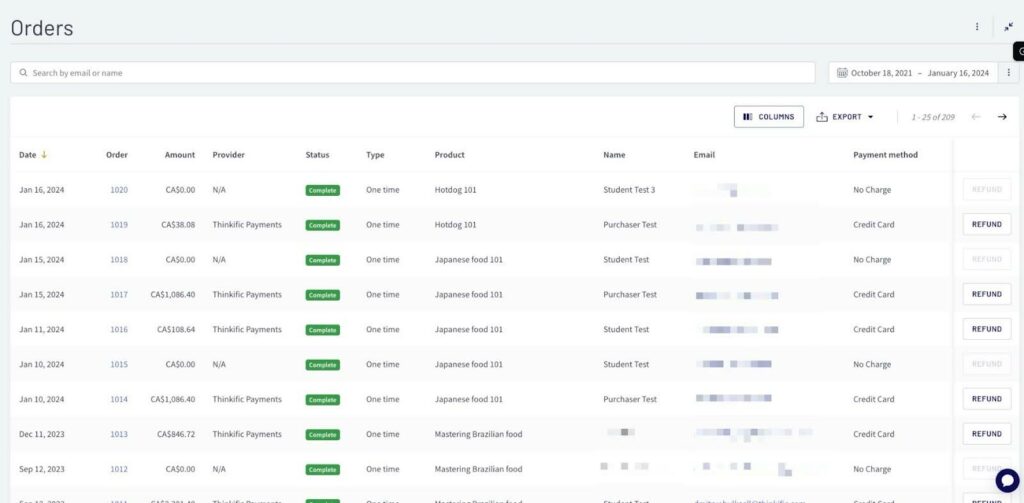

When the learner completes their purchase using a BNPL provider, you’ll receive the full transaction amount in your bank account, similar to credit card transactions. You’ll also be able to see which provider the learner used to buy your product through the Orders Table or Transaction Table.

Digital Wallets

Digital wallets are electronic versions of physical wallets, and many people use them because they allow people to store and manage their credit and debit card information in a secure digital format.

With TCommerce, you can offer your learners the option of purchasing your products through digital wallets like Apple Pay, Google Pay, Cash App, and Link by Stripe. In fact, we discovered that offering Link by Stripe as a payment method can increase conversion rates by more than 7%.

This flexible and convenient payment method allows people to complete transactions quickly without having to enter their payment information or use a third-party payment gateway provided they already use the digital wallet they chose on the checkout page.

Integrated Bookkeeping Tools

Bookkeeping is an integral part of running a business. But we understand that you might not like the entire process of working with numbers and calculating things like income, expenses, and profits in a spreadsheet. It’s overwhelming, especially if your business grows fast.

That’s why TCommerce has built-in tools to ensure that your financial reports stay accurate (no missing, duplicate, or misclassified transactions) and that your business complies with sales tax laws and regulations.

TCommerce Reports

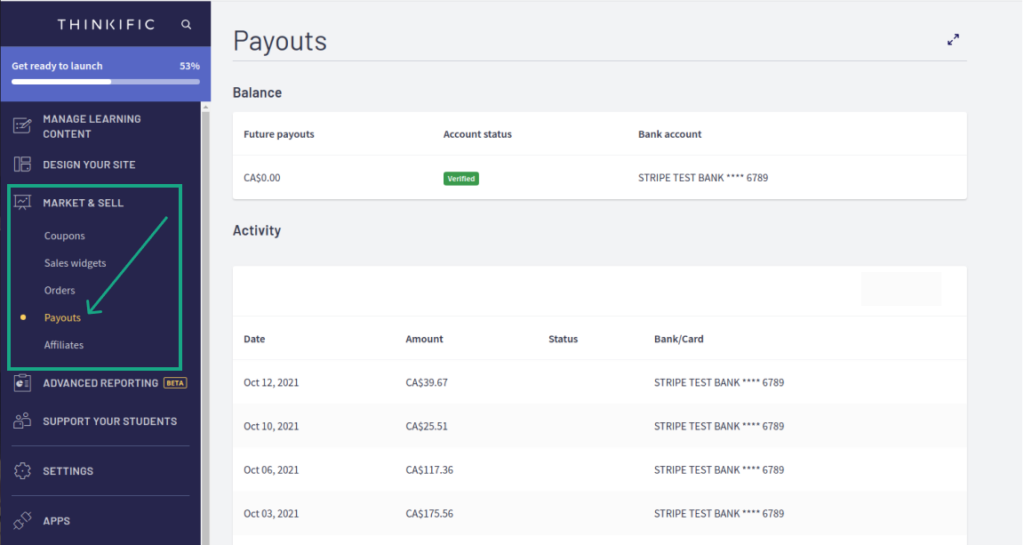

TCommerce Reports are of two types: the Payouts Report and the Order Transactions Report. The Payout Report shows you all the funds deposited in your bank account, while the Order Transactions Report comprises detailed information on each customer’s purchases.

When reconciling your books, compare these two reports to ensure that the number of orders you got tallies with the funds that were deposited into your account. For example, if you sell an online course for $70/seat and you get 35 sales in April (according to your Orders Transactions Report), you should have $2,450 total in your Payouts Report. If you have less than that, then some transactions are unaccounted for.

You can also use these financial reports to gauge how well your business is growing and if it is healthy financially. The four core metrics you should constantly keep an eye on are:

- Expenses. The money you spend on your business (e.g., marketing budget, cameras, graphic design expert’s salary, etc.);

- Profit. The money you make after deducting all your expenses;

- Income Taxes. The money you pay to the government every year; and

- Cash Flow. The money you have in the bank to cover future expenses.

The first two metrics, Expenses and Profit help you determine if your business is profitable or has the potential to be. Ensure that you’re not spending more money than you take home every month. The other two metrics ensure that you’re paying the right amount of taxes on time and that you have enough money in the bank to fix problems, should any arise in the future.

You can also get more granular with the reports and track other Key Performance Indicators (KPIs) like:

- The number of Order Bumps sold

- The performance of your affiliate program, if you have one

- How many courses you’ve sold compared to other products

- Which products are not selling at all

Metrics like these help you identify any problems in your business and build strategies to fix them.

Read: Simplify Bookkeeping with TCommerce

If you use the QuickBooks app for your bookkeeping, you can auto-sync your Thinkific Payments data with your QuickBooks account. Thinkific partnered with Acodei, a third-party app developer, to help our customers seamlessly sync their transaction data to QuickBooks in real-time, including sales, refunds, payouts, fees, and taxes.

This minimizes errors and lets you get up-to-date financial information directly in your QuickBooks dashboard, streamlining your accounting and reconciliation workflow.

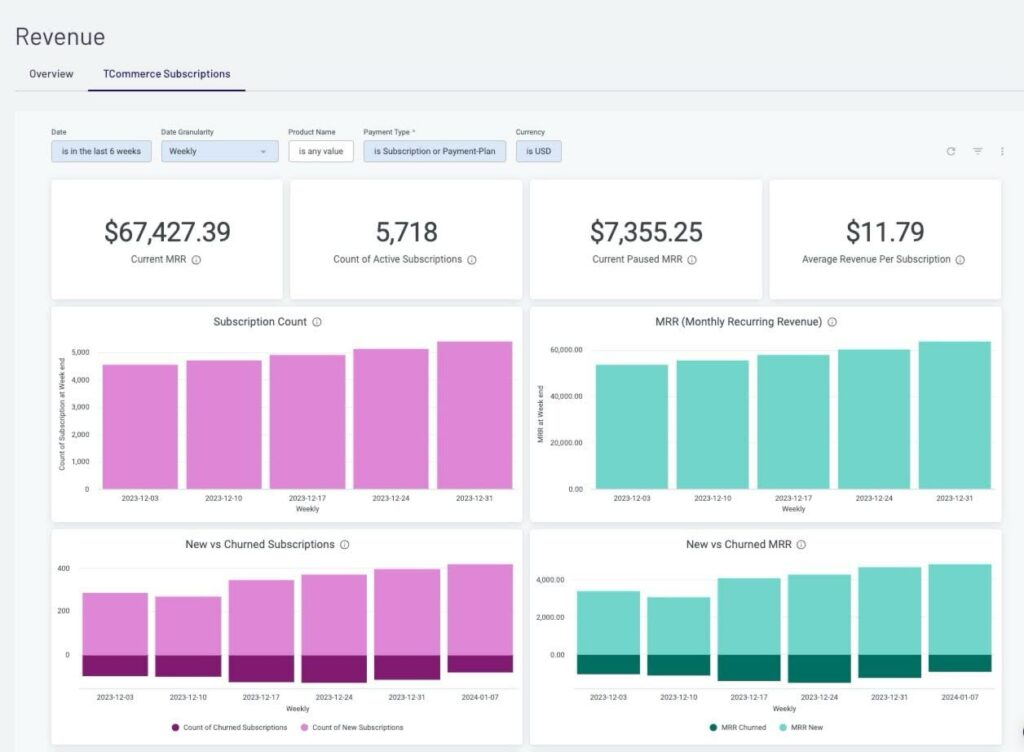

Subscriptions Dashboard

If you sell subscription-based products, you’ll need a centralized dashboard through which you can navigate your recurring revenue streams and get powerful insights into your chosen metrics. That’s what TCommerce’s Subscriptions Dashboard does for you.

This dashboard, which is a component of Thinkific Analytics, provides both bird’s-eye and granular views into your subscriptions and payment plans, allowing you to gauge how they’re performing and make data-driven decisions on how to make them perform even better. Plus you don’t have to worry about managing multiple dashboards for all your metrics; this one can track and present data from different payment gateways all in one dashboard.

The dashboard allows you to track key metrics, such as total subscription plans sold, value per learner, average churn rate, and customer lifetime value (CLTV or CLV), which helps you establish benchmarks for success and forecast future revenue. You can also pinpoint new growth opportunities and fix any issues you discover.

For example, you could proactively create a strategy to engage churned learners and re-convert them or you could find your top learners and focus your marketing efforts on them to drive greater success.

Automated Tax Solution

Doing your taxes is arguably the most annoying, boring, and complex part of running an online business. But you have to do it, though, because paying your taxes on time keeps you out of jail.

But here’s the kicker: As your business grows, so do your tax obligations, and trying to figure out the mechanics behind tax requirements prevents you from doing what matters most: growing your business.

Why?

Because in the United States and Canada, tax requirements vary across different states and provinces, and they change frequently. To pay the right taxes, you have to understand the tax laws and regulations in your jurisdiction as they relate to your business, as well as in the jurisdictions of all the countries and cities where your customers are located.

Getting all the details right is a headache. But if you don’t calculate everything right, your business might end up underpaying (or overpaying) taxes. When you underpay taxes, the government will hit you with fines, and if you overpay, your business loses money. Hiring an accountant to sort out your taxes also costs money, which you may not be able to spare if you’re still a small business. Whichever way you spin it, it’s a lose-lose situation.

But it doesn’t have to be.

Some governments have laws that require online selling platforms like Thinkfic to collect sales tax on behalf of their sellers. This means that if you use Thinkific Payments, TCommerce will automatically collect and remit tax on purchases made by students located in the US and Canada. So you can focus on the interesting parts of running your business, rather than spending hours doing tax-related calculations.

“We sell courses to learners all across the US and it can be difficult to understand the regulations related to sales taxes in each state,” says Christopher Wolfe, O.D., FAAO, Dipl. ABO, Exclusively Eyecare. “Thinkific has made the process of collecting and paying sales tax so simple that I am not even aware of it going on in the background.”

Remember when we said that TCommerce calculates your tax and adds it to the price of your Group Orders before the sale is processed? Well, it does the same thing for all purchases, not just Group Orders. So if you sell an online course for $167 and a student in Maryland buys it, they’ll pay $177.02 (with $10.02 being the applicable tax). So you get to keep your full $167, instead of having the tax deducted from your earnings.

Because TCommerce is handling your sales tax, there’s zero chance of underpaying (or overpaying) taxes or violating any tax laws. This means that your business is protected from unnecessary audits and penalties that come with non-compliance.

James Procter of ExamPrep has this to say about implementing TCommerce’s tax solution:

“The implementation of Thinkific’s sales tax solution was totally seamless and works incredibly well with my existing payment processing system. The solution automatically calculates the correct amount of sales tax based on our products and customer location. This has eliminated the need for manual tax calculations, which has made our sales process efficient and accurate.”

Learn more about how the Sales Tax Solution works here.

Thinkific Payments: An Integrated Payment Processor

What differentiates Thinkific Payments from other existing payment processors is that it is truly integrated. This means you can manage payments, refunds, and subscriptions all in one place without using any third-party processors.

Think about it: First, you get the most optimized, secure, and high-speed checkout process ever. The Performance Checkout, as we call it, is an out-of-the-box feature that provides a frictionless experience for customers: it has minimal required fields, validates information in real-time, auto-populates fields for returning customers, and allows customers to purchase your products with a single click.

You also get amazing selling tools like Gifting, Order Bumps, Group Orders, Incomplete Purchase Reminders, and Smart Retries, all of which are designed to help you boost conversions, skyrocket your revenue, and grow your business exponentially.

But it doesn’t end there. There’s the Buy Now, Pay Later feature, which accommodates customers with varying budgets, and the option to let people pay with digital wallets that they already use.

TCommerce’s one-click payment controls allow you to easily make refunds with just one click, which saves a lot of time and allows you to focus your energy on more exciting work. You’re able to seamlessly refund, retry, cancel, pause, and resume payments, analyze your subscriptions, and streamline your business admin all in one dashboard — easy! Not to mention the TCommerce reports and QuickBooks integration, which simplifies the bookkeeping process for you. Oh—and you don’t have to deal with tax issues anymore because TCommerce handles that for you automatically, too.

It’s no wonder that customers on Thinkific Payments see 22% larger average transaction sizes.

Katja Swift, the founder of Commonwealth Herbs loves the automated nature of Thinkific Payments.

“Thinkific does all the work for me and it’s one less thing for me to stress about. It’s been on my list of stuff to figure out and now it’s off my list – I didn’t have to do anything, it’s just done!”