The way people are making sales online is constantly evolving – from mobile wallets to buy now, pay later options – which means the way businesses process online payments need to accommodate these evolving trends.

Deciding on the best online payment processor for your business can be an overwhelming ordeal… with so many options, how do you choose the right one for your business? This blog is here to help narrow down your choices and provide a comprehensive overview of the best online payment processors, so that by the time you’re finished reading you’ll know exactly which payment processor has all the features you need.

Without further ado, let’s dive into everything you need to know about choosing the best online payment processor.

Continue reading or skip ahead:

- Understanding online payment processors

- Comparison of the top 10 online payment processors

- How to pick the right online payment processor for your business

- Key takeaways

Related: What is The Best Payment Gateway for Digital Products?

| Online payment processor | Pros | Cons | Pricing |

Best for: Small businesses & startups |

|

|

|

Best for: Creators selling digital products |

|

|

|

Best for: E-commerce beginners |

|

|

|

Best for: Customizable features |

|

|

|

Best for: High-volume sales |

|

|

|

Best for: Fraud protection |

|

|

transaction with $0.10 cent daily batch fee

|

Best for: Versatile payments forms |

|

|

|

Best for: Affordability |

|

|

|

Best for: Large businesses |

|

|

|

Best for: Subscription -based businesses & custom solutions |

|

|

|

Understanding online payment processors

A payment processor is a third-party vendor that is used by businesses to help facilitate the logistics of accepting payments from customers. Online payment processors are responsible for verifying authenticity, providing security, completing transactions of any type, and solidifying payments to merchants. Payment processors handle the behind-the-scenes side of collecting payments.

Online payment processors are often integrated with payment gateways, which deal with the front-side of payments. Payment gateways collect customer card information and encrypt it for later processing via a payment processor, which is then used to initiate a transaction.

While figuring out the logistics of online payments may not be the most thrilling part of establishing an online business, it’s one of the most important aspects to properly set up.

Factors to consider when choosing an online payment processor

Choosing a reliable online payment processor will make your life a hundred times easier when it comes to running an online business. This is why it’s vital to ensure that your online payment processor is equipped with all the essential features your business needs to successfully complete transactions.

Here are some features to keep in mind when choosing the best online payment processor:

- Accepted payment methods – Does your payment processor provide flexible payment options for your customers? All major credit cards should be accepted, and offering a variety of payment options like Apple Pay and Google Pay will help improve checkout conversion rates. Enabling payment options such as buy now, pay later will allow customers the flexibility to pay over time, while your business gets paid right away.

- Website integration – Ensuring a seamless integration with the platform you’re using should be one of the first things you look for in an online payment processor. This determines if any coding is needed, although most payment processors can be fully integrated with your own website.

- User experience – If your customer has a hard time navigating your checkout process, that’ll deter them from wanting to complete a purchase. It should be simple and pleasant for your customers to purchase from you. Customer experiences can be enhanced with added features like incomplete purchase reminders, order bumps, and one-click payment controls for quickly issuing refunds.

- Guaranteed security – Payment processors need to uphold the PCI DSS standard, which is a global security measure for all entities that store, process, or transmit cardholder data or sensitive authentication data. It protects customers and helps reduce fraud.

- Recurring billing and subscriptions – Support for recurring billing and subscription is essential if your business uses these payment methods. This feature will allow you to optimize your recurring revenue streams and easily retry, cancel, pause, and resume subscription payments.

- Advanced tools – All-in-one platforms will offer advanced tools that you might not even realize you need until you try them. For example, reporting tools will help you gain deeper insights into your customer transactions and automated sales tax calculations can ease any extra stress that comes with running a business.

Our pro tip is to keep track of new payment trends as they continue to evolve to help better accommodate your customers – this will increase brand loyalty by showing them that your business is flexible and caters to their needs. Happy customer = happy (and lucrative) business!

Related: Tax on Digital Products: A Beginner’s Guide

Comparison of the top 10 online payment processors

We’ve done all the nitty-gritty deep-diving and have listed a comprehensive overview of our top 10 best online payment processors, in no particular order as each payment processor will be best suited depending on your business niche and needs.

In case you want to jump around, click on the links below for the different online payment processors we will review.

Here are our top 10 best online payment processors of 2024:

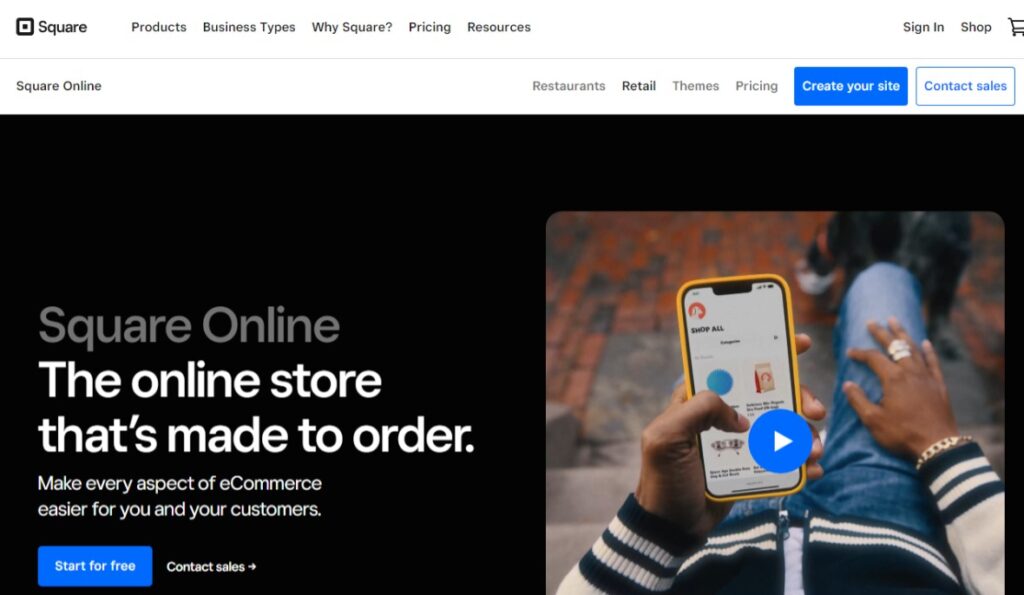

Square is one of the most popular payment processors (both online and in-person) for a good reason – it is extremely versatile and easy to use, making it good for small businesses and startups.

Square’s intuitive dashboard makes it so you can manage all your business data in one place. It allows for a simple yet efficient integration of online and in-person sales for a seamless payment processing experience.

One of the biggest perks that comes with using Square is the fully customizable online store that you can create if you don’t have a website to sell your digital products. They offer a ton of basic features, such as email marketing and feedback tools that are useful for setting up an online storefront.

Pros:

- Free basic plan

- Lots of integrations and add-on features available

- Hardware options

- Supports contactless payments and buy now, pay later

- Can launch a mobile site

- No chargeback fees

Cons:

- Most features are an extra cost

- Can be pricier for bigger businesses

- Limited customer support and no phone support

- No high-risk merchants

Pricing:

Square is very transparent with their fees and offerings, so you know exactly what you’re getting with no hidden costs. For online payments, Square’s rate is 2.9% plus $0.30 cents/transaction (discounted processing available on the paid premium plan). Their free plan has no setup or monthly fees, you only pay when you take a payment. Their paid plans with more included features start at $29/month.

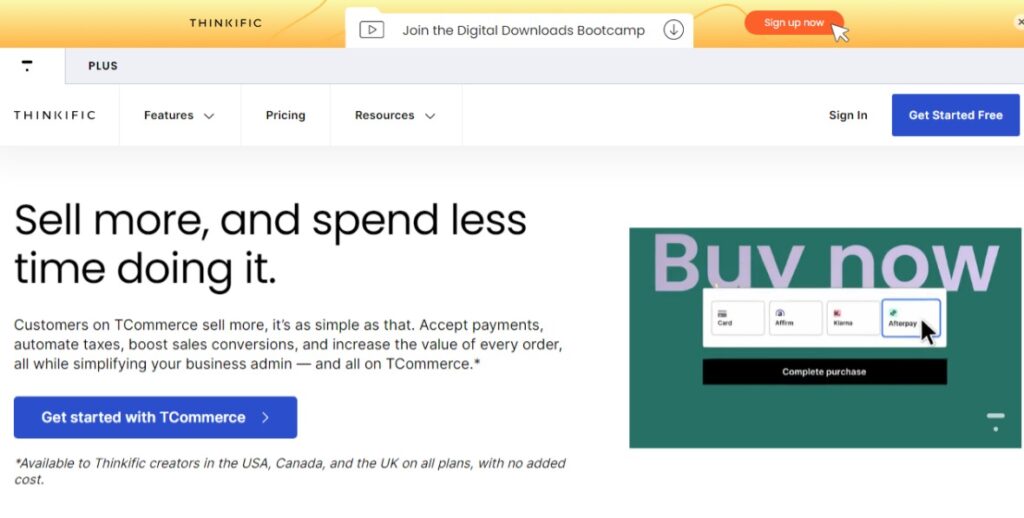

TCommerce (Thinkific Payments) is an all-in-one platform where you can accept payments, automate taxes, manage transactions, boost sales conversions, and increase the value of every order, all while simplifying your business admin.

TCommerce is a great option for those who specialize in selling any kind of digital product (for example, online courses and digital downloads). Their advanced sales tools, seamless payment processing, and effortless tax management simplify the process of running a business.

“Thinkific does it all seamlessly. So I don’t have to be a specialist in digital payments. TCommerce does all that for me.”

– George Levy, founder of the Blockchain Institute

Thinkific Payments allows you to manage payments and subscriptions and run reports all in one place, without relying on third-party processors. Some of their unique features include order bumps (suggesting complementary products at checkout that can be added to an order with a single click), gifting, group orders, and multiple payment methods.

Pros:

- Integrated all-in-one platform

- Simplified bookkeeping and reporting

- Supports contactless payments, buy now, pay later, and subscriptions

- Automated incomplete purchase reminder emails

Cons:

- No free plan (only 14-day free trial)

- Can only use if you have a Thinkific storefront

- Automated tax feature only available for Canada/U.S.

Pricing:

TCommerce is a payment processor that’s integrated into the Thinkific platform, and all plans have a 0% transaction fee. This is available to Thinkific creators in Canada, the U.S., and the U.K. on all plans, with no added cost. TCommerce has a 14-day free trial on their Basic Plan, which is $36/month.

Shopify Payments is another great all-in-one platform that is the best for e-commerce beginners as it has an easy to use and customizable interface. It allows you to create and manage your website, marketing tools, and payments all from one platform.

Shopify Payments is one of the simplest ways to accept payments online, as Shopify Payments eliminates the hassle of setting up a third-party payment provider or merchant account and having to enter the credentials into Shopify. You can automatically accept all major payment methods as soon as you create your Shopify store.

Pros:

- All-in-one e-commerce platform

- Easy to set up and use

- Flexible and customizable checkout

- Transparent pricing and fees

- 24/7 customer support

Cons:

- Not available in all countries

- Fee for using third-party payment gateways

- Pricey add-on options

- Can only use if you have a Shopify storefront

Pricing:

Shopify Payments processing starts at 2.9% plus $0.30 cents/transaction, which are waived as you go up the paid tiers. To unlock this and all of the Shopify features, you will need a Shopify plan, which starts at $39/month. Shopify also has a starter plan which is $5/month for simple online stores or selling through social media.

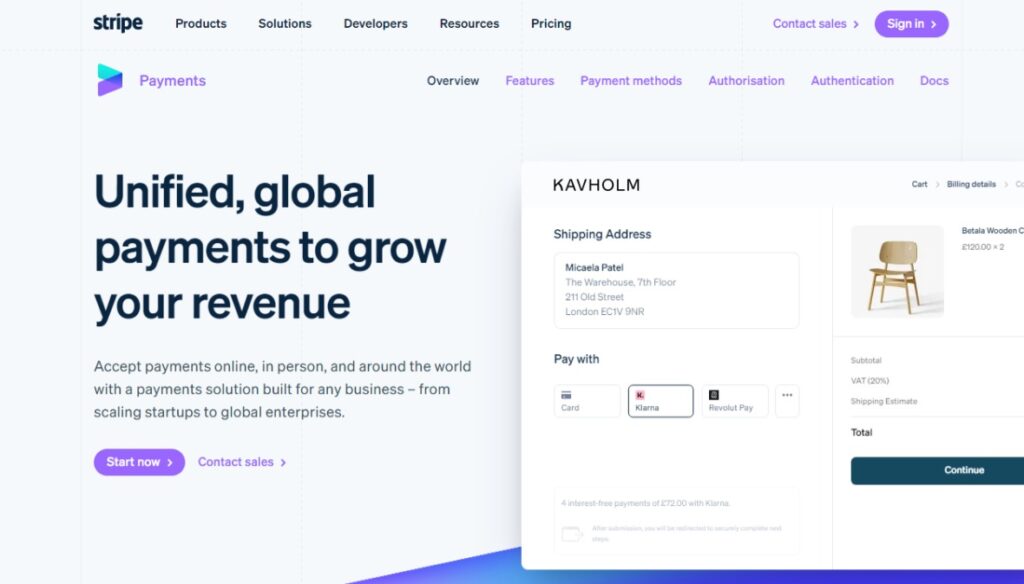

Stripe is a payment processor for online and in-person payments, offering a highly flexible solution for payment processing and payment gateways. Stripe integrates with your in-person payment system, allowing you to accept payments from multiple sources.

Some of Stripe’s unique features include ability to create invoices, automate taxes, process and manage subscriptions, take international payments, and share payment one-click links. Stripe is highly customizable with more extra features than you can count – some of which may require coding skills or the help of a developer. This makes Stripe a bit less intuitive than other platforms, although they are one of the top global payment processors for a reason, as you will notice with all the advanced tools offered.

Pros:

- Integrations with e-commerce platforms

- Unified payments in-person and online

- Flexible cross-border payment options available in 195 countries with over 135 currencies

- Pre-built customizable checkout

- Configure payment tools

- No-code built-in fraud protection

- Deposits payments directly into your account

Cons:

- No high-risk merchants

- Less beginner friendly

- No built-in POS system for in-person transactions

Pricing:

Stripe is very reasonably priced when compared to other online payment processors. You have access to their complete payment platform with simple, pay-as-you-go pricing. There are no setup fees, monthly fees, or hidden fees. Stripe processing is 2.9% plus $0.30 cents/transaction per successful charge for domestic cards.

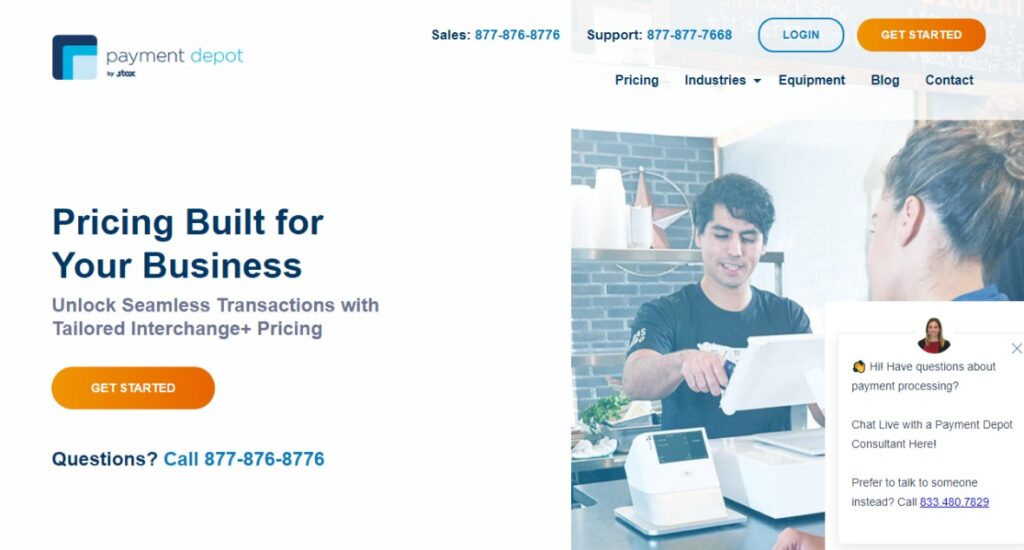

Payment Depot is a great option for businesses with high-volume sales that operate both online and in-person. They have POS, online, and mobile options that provide businesses with flexibility. Payment Depot comes with a variety of virtual and physical terminals, and it’s easy to set up and use.

Payment Depot is unique as it’s a membership platform that offers subscription fees which is based on a merchant’s monthly transaction volume. This pricing model allows businesses to save hundreds every year on credit card processing fees. Their payment processing services work best with high-volume sellers who frequently process high-volume transactions.

Pros:

- Transparent pricing

- No setup or cancellation fees

- Accepts all major payment types

- 90-day free trial

- 24/7 customer support

Cons:

- Best for larger businesses

- No high-risk merchants

- Limited add-ons and features

- Not as customizable as other platforms

Pricing:

Payment Depot’s membership pricing ranges from $79 to $199 per month, with a monthly transaction limit of $25,000 to over $300,000 depending on the plan. Their transaction fees are lower than other platforms, with fixed rates of $0.07 cents to $0.15 cents per transaction, along with an interchange rate.

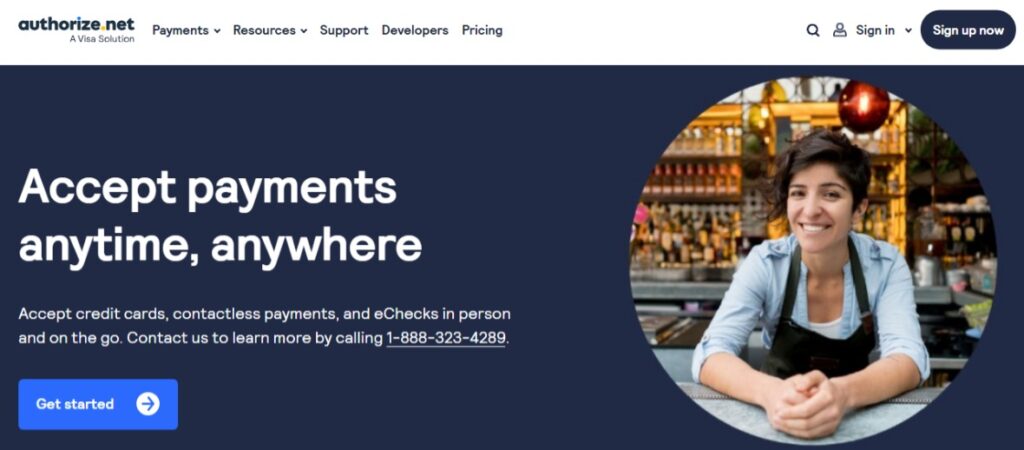

Authorize.net is the most secure payment processor with their Advanced Fraud Protection Detection Suite (AFDS). They have a simple, easy to navigate interface that works for businesses of all sizes and types.

Authorize.net also offers a vast selection of flexible payment options online, including the ability to accept electronic check payments from your customers. Some of their features include account updaters and customer information managers to facilitate smooth transactions and a pleasant user experience.

Pros:

- Easy integrations

- Simple checkout

- Supports contactless and recurring payments

- Digital invoicing

- Protects against chargebacks

- No setup fees

- 24/7 support

Cons:

- Limited to Europe, Canada, U.S., U.K., and Australia

- Extra costs for features

- Not as many features as other platforms

- Limited customization

Pricing:

Authorize.net starts at $25/month across their different plans (with the first six months free for a limited-time offer), with a $0.10 cents/transaction processing fee along with a $0.10 cent daily batch fee. For their all-in-one plan, if you don’t already have a merchant account, transaction processing rates are 2.9% plus $0.30 cents/transaction.

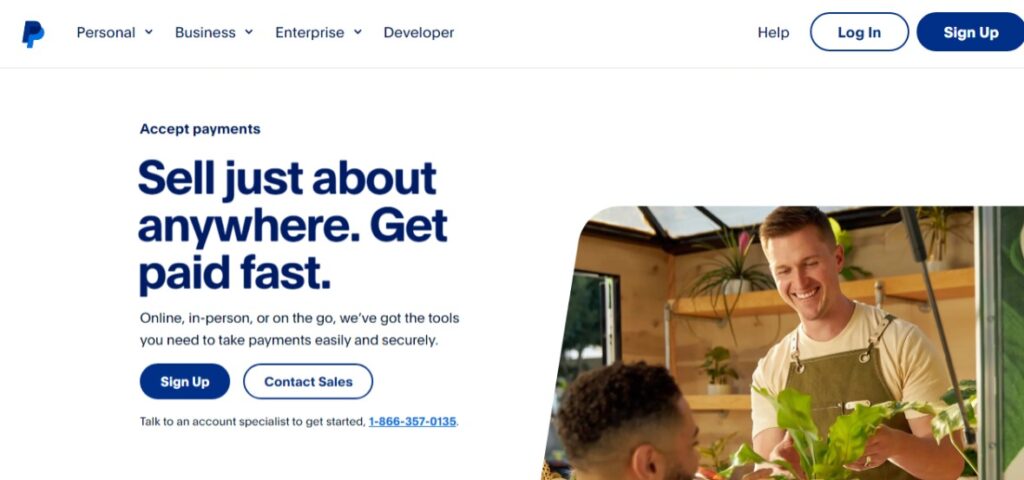

PayPal is a universal payment processor that is the most widely recognized and accepted across the globe. This enhances customer trust and could enable more spontaneous transactions.

It’s a great payment processor to sell any kind of digital product online as it has multi-channel payment options, giving you the chance to sell across a wide range of devices and platforms. It’s unconventional selling methods, such as through Venmo, QR codes, payment links, and buy now, pay later financing, make PayPal stand out as a leading online payment processor.

Because PayPal has so many different selling methods and features, this makes their fee structure hard to grasp. Due to the complex nature of their pricing structure and their higher fees than other platforms, PayPal is better suited for smaller businesses and not as ideal for bigger businesses with high-volume sales.

Pros:

- Simple set up and use

- Secure transactions

- Easy integration with other platforms

- Unconventional selling methods

- Instant access to sales

- Good invoicing features

Cons:

- Complicated pricing structure

- Popular target for phishing and scammers

- Limited customer service

- Can’t customize certain aspects

Pricing:

PayPal’s pricing structure varies due to the vast amount of countries and currencies they support, and the different ways in which you can process payments using PayPal. Their baseline pricing structure involves a 2.9% fee along with a $0.30/transaction fee for the U.S. and Canada, and a 4.4% fee and above for international transactions.

Helcim provides affordable payments for businesses that operate online and in-person. It’s another great option for businesses who tend to frequent high-volume sales, as Helcim uses an interchange-plus pricing model. This can save businesses money when customers use a card that has a low interchange rate, which refers to the payment network in charge of processing (such as Visa, Mastercard, American Express, etc.). This pricing structure benefits larger businesses, as the interchange plus fees decrease with more sales profits.

Some of Helcim’s features include a virtual terminal, involving, and a subscription manager.

Pros:

- Easy and quick setup

- Customizable features

- Automatic high-volumes sales discounts

- Mobile device processing

- No monthly or hidden fees

Cons:

- Best for larger businesses

- No high-risk merchants

- Features cost extra

- Limited customer support

Pricing:

There is no monthly fee or hidden costs with Helcim, only transaction processing fees which are 2.49% plus $0.25 cents for online transactions and 1.76% plus $0.08 cents for in-person transactions.

Stax is another online and in-person payment processor that uses an interchange pricing structure. Their goal is to enable flexible, multi-channel payment processing and invoicing solutions through an all-in-one business management platform built to help you run and grow your business.

This platform enables the acceptance of multiple payment types and the seamless integration of necessary tools within a single dashboard. Stax offers customizable smart terminals and mobile readers. You can access deposits, payment activity, sales trends, and more with Stax.

Pros:

- Over 150 integrated software partners

- Supports contactless payments

- Embedded payments (payment links, buttons, and QR codes)

- Customizable

- Range of included features

- 24/7 customer support

Cons:

- Better for high-volume sales

- Optional add-ons for a price

- Pricing isn’t as transparent as other platforms

- No high-risk merchants

Pricing:

Subscription plans for Stax start at $99/month if your business is processing up to $150,000 per year. This price increases as business transactions increase. They also offer custom quotes for larger businesses.

Payline Data is an online payment processor that offers solutions tailored to your business. Its model is ideal for subscription-based businesses because of their unique features that allow businesses to calculate monthly costs with their transparent pricing model. Payline Data offers strong recurring billing and invoicing capabilities that help merchants accurately calculate their payment processing fees.

This is a user-friendly option for small-medium size businesses. Some of Payline Data’s features include API and developer docs, a virtual terminal and dashboard, and a cart integration and payment page. They provide a safe and secure platform for transactions.

Pros:

- Easy to use

- Transparent pricing

- Many integrations available

- Dedicated account manager

- Next-day deposit for funds

- Works with high-risk merchants

- No hidden fees

- 24/7 support

Cons:

- Requires more technical knowledge than some platforms

- Higher transaction fees for online payments

- Hardware costs aren’t available on site

Pricing:

With Payline Data you get your first month free to test out their services. They have separate monthly fees for online and in-person processing – online is $20/month and 0.75% with $0.20/transaction fees and in-person is $10/month and 0.4% with $0.10/transaction fees.

Related: 10 Best Side Hustle Ideas To Make Money Online in 2024

How to pick the right online payment processor for your business

Now that we’ve gone through all the best online payment processors and their unique features, it’s time for you to choose the best online payment processor for your business.

Remember to pay attention to the varying security features, customer support, integration options (compatibility with your website, e-commerce platform, or accounting software), supported payment methods (contactless, credit and debit cards, QR codes, and payment links), and the transaction fees (which affects your bottom line).

Choosing the right online payment processor can be challenging as pricing and transaction fees differ, along with the bonus features that are included. We recommend assessing your business needs and priorities, then test any of the free-trials or discounted first months to get a feel for each online payment processor. Consider how each payment processor will affect your scalability and future growth.

Related: How TCommerce Helps You Sell More

Key takeaways

There you have it – our complete guide to the best online payment processors out there in 2024!

Ready to get started growing your business? TCommerce, through Thinkific Payments, streamlines the process of accepting payments from students worldwide. With advanced selling tools, optimized payment solutions, and integrated bookkeeping tools, this all-in-one payment processor will help ease the behind-the-scenes stress that comes with running your own business.